These methods go beyond basic percentage changes and provide deeper insights into a company’s financial performance and trends. Just like horizontal analysis, vertical analysis shows useful information and insights about the health of your finances. Vertical analysis is conducted on financial statements over multiple periods and can be used to identify ratio changes.

Compare the results of horizontal analysis with industry benchmarks or competitors’ performance to assess how the company fares against its peers. There were rises of more than 12% in all categories of property other than transport equipment. This type of analysis in the balance sheet is typically done in a two-year manner, as illustrated below, with a variance indicating the difference between the two years for each line item. However, an extra vertical analysis approach is required for management and innovators to make better-informed judgments. When it comes to management, it determines the actions to take in order to improve the future performance of the firm. In general, the method aids in understanding a company’s performance so that educated decisions may be made.

Purpose and Benefits of Horizontal Analysis

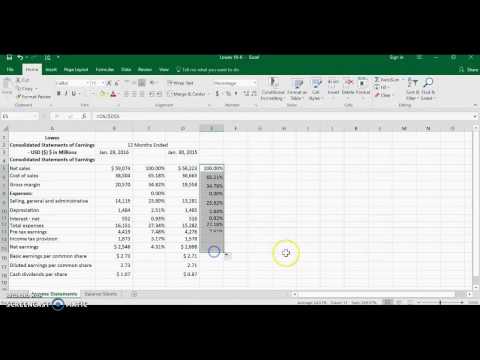

Look for consistent positive or negative changes in financial metrics to assess the overall direction and performance of the company. Perhaps, the most important aim of financial analysis is identifying your company prospects through trends for both the near future and long-term periods. How detailed your initial financial statements are depends largely on the accounting software application you’re using. If you’re using an entry-level application, it’s likely you’ll need to use spreadsheets in order to complete the horizontal analysis. At least two accounting periods are required for a valid comparison, though in order to spot actual trends, it’s better to include three or more accounting periods when calculating horizontal analysis.

For horizontal analysis, it’s best to take several years of historical data to gain useful insights into how a company is performing. This can help determine what is a clear trend and what may be a one-off event. Trend analysis is the evaluation of financial performance based on a restatement of financial statement dollar amounts to percentages.

Formulas for horizontal analysis

One item of note becomes more apparent as a result of the trend analysis above. Initially, it was stated that operating expenses were horizontal analysis formula increasing between 2019 and 2021. Based on trend analysis, however, these expenses are actually declining as a percentage of sales.

- Now, let’s dive into the specifics of performing horizontal analysis on income statements.

- Save time and effort with our easy-to-use templates, built by industry leaders.

- Look for patterns in the percentage changes across various financial statement items.

- Later, this data could be used to conduct a more in-depth examination of financial performance.

This can be useful in identifying areas of concern for a business, as well as improving the performance of companies that are struggling. When Financial Statements are released, it is important to compare numbers from different periods in order to spot trends and changes over time. This can be useful in checking whether a company is performing well or badly, and identify areas where it may improve.